1. The Philippine Stock Exchange Index (PSEi) is a capitalization-weighted index composed of stocks representative of the Industrial, Properties, Services, Holding Firms, Financial and Mining and Oil Sectors of the Philippine Stock Exchange (PSE) [Bloomberg]. It was up on 29 May 2020 because we had a net foreign buying of 955.39 Million Pesos; that means, foreign investors were buying shares of stocks in the PSE more than they were selling, which drove the PSEi up by 4.82% or 268.62 points from 5570.22 to 5,838.84 level. The proximate cause could be that there is some level of certainty now that businesses in the Philippines will open and operate come June 01, prompting foreign investors or traders to come in.

2. The role of foreign investors or traders in the PSEi is important as they add volume and liquidity in an otherwise thin market; simply put, they have the money that could instantly impact the performance of the PSEi. Absent foreign investors or traders participating in the stock market, PSEi would have no momentum to rally and breakout from its resistance level as what happened to PSEi in the past two and a half months.

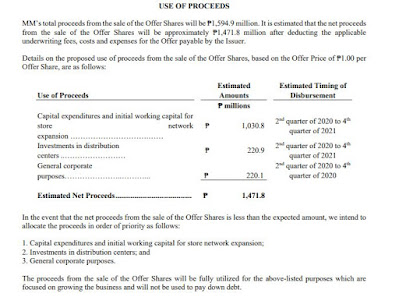

|

| The encircled green long column signifies large buying volume which can be primarily attributed to net foreign buying. |

3. It is actually only the second time since March 16 that we had net foreign buying. The first time was on 05 May 2020. All other days, we had net foreign selling, which suggests that foreign investors are pulling out their money from the market and placing it somewhere else. If we "follow the money" as the saying goes, we will probably end up in the global market where there is volume and liquidity. That's why some popular traders or investors have also focused their attention to the global market. I just follow suit and am starting to learn more about trading and investing in the US stock market for diversification. Of course, it is always recommended to invest or trade in our own stock market to help our economy recover or grow faster.