(Disclaimer: This is not a stock or investment recommendation. I am just thinking aloud. )

Image courtesy of https://merrymart.com.ph/

I am thinking about it.

Since I am not fully convinced in buying MerryMart Consumer Corp. (MM) at its Initial Public Offering (IPO) price of Php 1.00 per share, the answer is NO...for now. But I will monitor MM's stock price on June 15 (listing date) and perhaps do some intraday trading if the price is right.

As you may have already known, MM is a new player in the grocery and pharmacy retail industry, aiming to compete against the likes of Puregold, Robinsons, Mercury Drug, Metro Gaisano, and SM. MM's primary shareholder is Injap Investments, Inc. , which is the investment holding company of the Sia family --- the family behind Mang Inasal and Double Dragon Properties Corp.

MM seems to be attractive based on its prospectus. However, as of this writing, I am uncertain if it will be a good buy at Php 1.00 per share. I have considered the following factors:

1. Valuation.

MM is overvalued because it has a Price-to-Earnings Ratio (PER) of 271.2x in 2019 as compared to the average industry PER of 20.39x in 2019; this PER suggests that investors are willing to pay Php 271.2 for every peso of MM's earnings, when in fact, on the average, investors are only willing to pay Php 20.39 per peso-earnings in the retail industry.

Puregold only has a PER of 19.88x in 2019, while RRHI, the group that operates South Star Drug, has 32.13x. You can compare the PER of MM to the PERs of its competitors as shown below:

Image courtesy of https://www.abcapitalsecurities.com.ph

For an IPO, I prefer to buy stocks at a price close to the average industry PER regardless if it is above or below the average industry PER. In this case, MM's PER is 1,230% greater than the average industry PER. It is a huge difference, thus stockholders will definitely be paying a premium for a share of MM stock at Php 1.00.

When a stock is overvalued, its price tends to go lower. Hence, there is a huge possibility that MM's price would drop from Php 1.00/share. If it happens, stockholders who bought the stock at Php 1.00 would be at loss, unless they managed to immediately sell the stocks at a higher price or managed to cost-average.

2. Use of IPO proceeds.

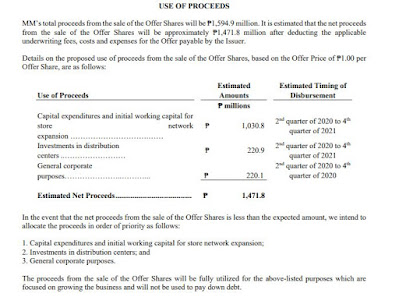

A company is attractive if a substantial amount of the IPO proceeds goes to expansion rather than debt repayments. As investor, I do not want to invest in a company which will use my money just to pay off its debts. I want the company to use the money to grow and reap profits.

In the case of MM, substantial amount of IPO proceeds will go to capital expenditure and working capital for store network expansion thereby making MM very attractive. In fact, MM's prospectus shows that no IPO proceeds will be used for debt repayment.

Screenshot of MM's prospectus re: Use of Proceeds

However, it bears noting that MM wants to achieve faster expansion through franchising according to its prospectus. This begs the question: what really are the IPO proceeds for if MM will capitalize on the financial capabilities of its own franchisees for its expansion?

3. Business Model and niche market.

A company is attractive if it will address specific market needs which a very few establishments only satisfy. As investor, I do not want the company to dip into a saturated market.

In a saturated market, there is already a lot of companies offering the same products and services meeting the demands of the market. There is no untapped demand in a saturated market, hence there is no need for a new player to come in unless the new player introduces an innovation in the market.

In the case of MM, its "innovation" is its "three-in-one concept", which combines a mini-grocery, personal care shop, and pharmacy in one store. According to MM's prospectus, this innovation of 3-in-1 store "will eliminate the need for several management

positions and streamline this requirement to one pharmacist who will also act as the branch manager of the said

three-in-one household essentials store."

You may observe that Mercury Drug, South Star Drug and Watsons already have this 3-in-1 concept. In all of these stores, you could buy your groceries and personal care products, and at the same time buy your medicines. Mercury Drug and South Star Drug also have 24/7 stores like any other convenience store.

But it would be nice to have more convenience stores with pharmacies scattered all over the country, right?! That could be MM's market niche.

4. The fact that Edjar "Injap" Sia is the man behind MM.

Injap Sia was successful during the IPO of Double Dragon Properties Corp. when its price rose 50% at its PSE debut. Manny Villar was also successful during the IPO of Golden Haven Memorial Park when its price rose 49.90% at its PSE debut, but he did not get the same results during the IPO of AllHome Corp. This begs the question, will there be a repeat successful performance for Injap Sia? History taught us that there is no guarantee for a repeat successful performance. But anything is possible.

5. Increased demand for groceries and pharmaceuticals during the COVID-19 pandemic.

During the Enhanced Community Quarantine, supermarkets, convenience stores and pharmacies were one of the few establishments which were allowed by the Philippine government to operate. They are considered essential. Thus, it is nothing but natural for MM to gain interests from investors because its operations are not as hardly hit by the pandemic as the other establishments; this is the reason why MM is already oversubscribed, according to PNB Capital. This might also be the reason why MM is overvalued. Its business is essential and resilient in times of pandemic, and investors believe that it could produce higher earnings in the future.

Conclusion:

Will I buy after processing my thoughts? I am still thinking about it.

If I finally decide not to buy MM at its IPO Price, I will observe MM's price action on June 15 and see if it is worth a trade.